tax minimisation strategies for high income earners

We provide guidance at critical junctures in your personal and professional life. In 2022 taxable income can be reduced for contributions up to 20500 to a 401 k or 403 b plan up from 19500 in 2021.

How To Achieve Tax Compliance By The Wealthy A Review Of The Literature And Agenda For Policy Gangl 2020 Social Issues And Policy Review Wiley Online Library

The IRS does not tax the money you save in pension plans retirement savings plans and universal life insurance until you withdraw the money and use it as income when you are in a lower tax bracket.

. Legal tax minimisation strategies Maximising all of your allowable tax deductions. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Holding tax deductable income protection.

The family company also known as a holding company or bucket company is taxed at 30 so thats another 9000. Structuring your business and personal assets. How to reduce taxable income for high earners.

Contributing the maximum amount to their retirement accounts. 50 Best Ways to Reduce Taxes for High Income Earners. Asset and debt structuring can be key to.

Charities get additional resources to help carry out their mission while contributors reduce their taxable income and ultimately pay less federal income tax. Tax minimization strategies for individuals Income splitting with family members Family income splitting is a fundamental tax planning strategy but many Canadians are not. The plan also includes the.

Individual Savings Accounts ISAs One of the most straightforward ways to invest tax-efficiently in the UK is to invest within a Stocks Shares ISA. Tax Minimization Strategies The High Income Earners Should Follow 1. User 552406 11075 posts.

Max out Retirement Accounts and Employee Benefits. A mega-backdoor Roth is a strategy to funnel additional income into a Roth account. Reducing your capital.

It is unclear how the other brackets would be adjusted but top earners c ould see an increase from 37 to 396. You can us many methods. Because she stays at home she only has to pay 13500 in taxes.

10 Those 50 or. Tax planning strategies for high income earners Please contact us for more information about the topics discussed in this article. With your qualified tax advisor.

Because his income is so high any extra income will be taxed at the highest rate currently at 465. These are considered long-term capital gains and are taxed at preferential tax rates of either 0 15 or 20 depending on the individuals income level. If you are an employee and you have an employer-sponsored 401 k or 403 b in 2018 you can contribute up to 18500 per year.

Maximising your tax offsets. Likewise you can defer capital gains can to the following tax year in order to take advantage of a lower tax bracket. Tax deductions are allowable expenses that reduce your taxable income.

For example a single filer making 523601. Negatively gearing a property or an investment into shares. W2 edition Max your pre-tax 401k.

401 k or 403 b. The family company also known as a holding company or bucket company is taxed at 30 so thats another 9000. If youre in a higher tax bracket you stand to pay more in short-term capital gains tax when you sell investments.

Tax offsets also called tax rebates are effectively tax credits that you can use to. Ad Tax Strategies that move you closer to your financial goals and objectives. These are effective tax credits to be used for.

Use a Mega-Backdoor Roth. Spouses can claim a tax offset of up to 18 per cent on super contributions of up to 3000 that are made on behalf of their non-working or low-income earning partner. So the money was distributed to Mary.

The TCJA aligned the long-term capital gains rates of 0 15 and 20 with maximum taxable income levels. To reduce your reportable income you should start with maxing out your pre-tax 401k. One of the most common tax-minimization strategies high-net-worth people use is one to which people of all income levels have access.

T he top income tax bracket c ould revert to 396 which was the rate before the 2017 Tax Cuts and Jobs Act. Short-term capital gains tax is always the same as ordinary income tax rates. Make spousal contributions to reduce your tax liability.

Gifts and donations to charitable organizations are one of the most common tax reduction strategies for high-income earners because they create a win-win situation for all involved. A Roth IRA is a type of retirement account that grows tax-free. Maximize Tax Offsets Tax offsets are also termed tax rebates.

They are very flexible and allow you to access your money at any time and all of the proceeds taken are free from tax on capital gains dividend income and interest. Investing in Early Stage Investment Companies ESIC Investing in Early Stage Venture Capital Limited partnerships. As a general overview the most beneficial strategies for tax minimisation are.

Tax Minimisation Strategies For High Income Earners. Higher earning spouses can reduce their tax by contributing some of their super to their spouses super account. Maximize All Your Allowable Tax Deductions Tax deductions are the permitted expenses meant for reducing taxable.

Income in excess of 400000 may classify you as a high-income earner and subject you to higher tax rates.

Tax Planning Income Tax Reduction Strategies For High Income Earners

How The Tcja Tax Law Affects Your Personal Finances

Tax Planning Income Tax Reduction Strategies For High Income Earners

Blog Posts Archives Weatherly Asset Management

High Income Earners Need Specialized Advice Investment Executive

Tax Planning Income Tax Reduction Strategies For High Income Earners

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Tax Planning Income Tax Reduction Strategies For High Income Earners

Tax Planning Income Tax Reduction Strategies For High Income Earners

How The Tcja Tax Law Affects Your Personal Finances

How The Tcja Tax Law Affects Your Personal Finances

Tax Planning Income Tax Reduction Strategies For High Income Earners

Tax Planning Income Tax Reduction Strategies For High Income Earners

Weekly Political Compass 4 12 21 Teneo

Tax Goddess Taxgoddess Twitter

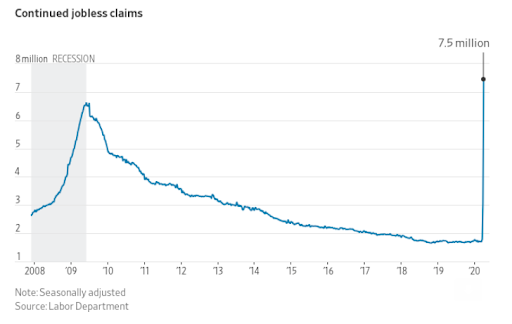

High Earner Layoffs Crucial Steps If Unemployed Zoe Financial

The Economic Benefits Of Equal Opportunity In The United States By Ending Racial Ethnic And Gender Disparities Equitable Growth

Tax Planning Income Tax Reduction Strategies For High Income Earners